Despite strong adoption on the supply-side of the Bitcoin network, there are now more positive BTC addresses than ever.

On-chain statistics via February have recommended a positive view for Bitcoin as addresses with a non-zero balance of BTC got to an all-time high.

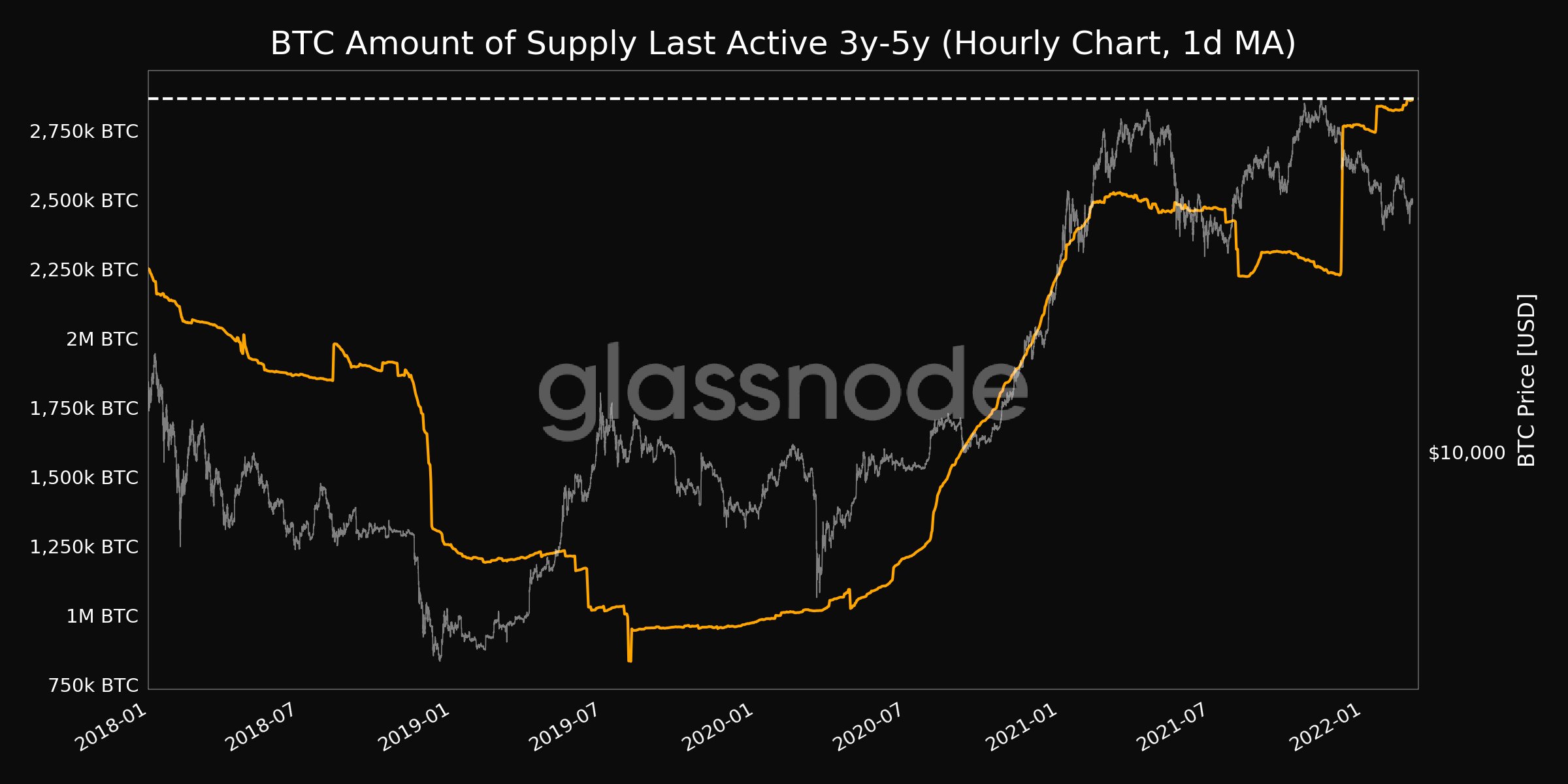

Additionally, those purses with a positive BTC balance are progressively hodling their coins. The quantity of BTC distributing supply last relocated between three and also 5 years ago reached a four-year high of just over 2.8 million coins, according to data from on-chain analytics firm Glassnode.

https://twitter.com/glassnodealerts/status/1498059282020974597?s=20&t=xt3j-OQlsLPeKvQCya32Xg

The number of addresses with a non-zero balance got on a high rise via 2019 and also 2020 until the center of 2021, when growth appeared to have plateaued at about 35 million addresses. Nonetheless, development in these statistics has surged considering the start of 2022, leading to a new ATH of 40,276,163 according to Glassnode.

The unexpected spike in BTC supply that was last active 3 to five years ago coincides with the height of the last extended advancing market at the start of 2018.

Amongst the addresses with a non-zero equilibrium, Glassnode reported that 817,445 of them have at the very least one entire BTC, a 10-month high on Feb. 28.

Arm Your Trading Station with Markets Pro! — CLICK HERE TO GET IT!

Supply-side characteristics in Bitcoin have given several metrics of note this previous month. FSInsight reported on Feb. 9 that 75% of the BTC flowing supply was illiquid because it had actually not moved for an extended amount of time. The monetary research study company’s report explained the circumstance as a “powder keg” that prepares to blow as quickly as a moderate amount of BTC is acquired on the market.

Political turbulence in Canada and Ukraine in February has also shed more light on Bitcoin’s ability to stay censor-proof. Some Canadians have adopted Bitcoin to shield their funds from being frozen, while the Ukrainian federal government is currently approving BTC contributions as stress escalates in the area.

BTC is presently trading at $37,827, down around 45% from the Nov. 10, ATH of $69,000 according to CoinGecko.