A week unlike any other in Bitcoin’s history is suddenly here as hodlers support for assured chaos.

Bitcoin (BTC) starts a brand-new week in the darkness of a new geopolitical problem– what are the main obstacles that capitalists encounter?

In what has actually become an indistinguishable macro-environment contrasted to even days ago, Bitcoin, like many various other assets, is feeling the pressure.

Russia’s invasion of and also succeeding battle against Ukraine is ruining global markets, as well as growths can upend belief within hours or simply mins.

The timing has actually hit Bitcoin, too– its “safe house” top quality is seeing a major examination, as investors try to find security and also fiat bagholders try to find a leave.

As the overriding influence today, Cointelegraph has a look at what could lie in store for Bitcoin in the short term as it holds up against complicated and also nearly surreal macro events.

5 subjects for BTC financiers today can be found listed below.

The war in Ukraine dominates

It does without claiming that the Russia– Ukraine conflict is the main motorist of market efficiency this week.

The circumstance, having actually only emerged in its present type five days back, stays in a state of continuous change– sanctions keep coming, both sides, as well as their allies, remain to knuckle down, markets react to brand-new dangers and probabilities.

Chief among them is Russia’s economy, which is bracing for chaos on Monday. Stock trading has actually been pushed back to at the very least 3 pm local time, and the diagnosis is bleak for its currency, the ruble, which is currently trading at record lows.

Talks are scheduled to begin Monday, and any kind of twinkle of hope could trigger an about-turn in the temporary overview and also, therefore, alter the face of markets.

While uncertainty guidelines, however, everybody will be looking for the ultimate safe haven, as well as Bitcoin’s use– whether by common Russians as well as Ukrainians or their governments– is already a chatting point.

As Cointelegraph reported, Ukraine’s military has already increased numerous bucks in crypto help, and also far-ranging assents versus Moscow could yet facilitate a pivot to Bitcoin as an economic device.

The suggestion has actually not passed the establishment by– Mykhailo Fedorov, deputy president of Ukraine, gotten in touch with exchanges to block Russian and also Belarusian customers’ funds.

” Bitcoin is like a blade to a specialist or a blade to a criminal,” podcast host Preston Pysh wrote at the weekend, summarizing the situation.

” Like any useful innovation throughout time, its value originates from the intent behind its usage.”

Markets, at the same time, will likely be driven relying on shifts in occasions on the ground as well as knock-on effects for federal governments.

https://twitter.com/zhusu/status/1498112426029772801?s=20&t=3uHSG70ykJClE9BxGGqfoQ

Until now, oil– but not Russian oil– has been one of the few beneficiaries of the war, while Bitcoin has handled to continue to be fairly stable– unlike gold, which initially gained quickly and after that lost all its recently won ground.

Bitcoin and also altcoins’ connection to standard securities market stays, however, and also low timeframes are therefore proper to provide an actual frustration for traders no matter what transforms the war takes.

Place price action faces macro force majeure

With conventional markets positioned to be extremely unpredictable on their particular Monday opens, thinking exactly how Bitcoin will fare on the quickest duration is an actual trouble.

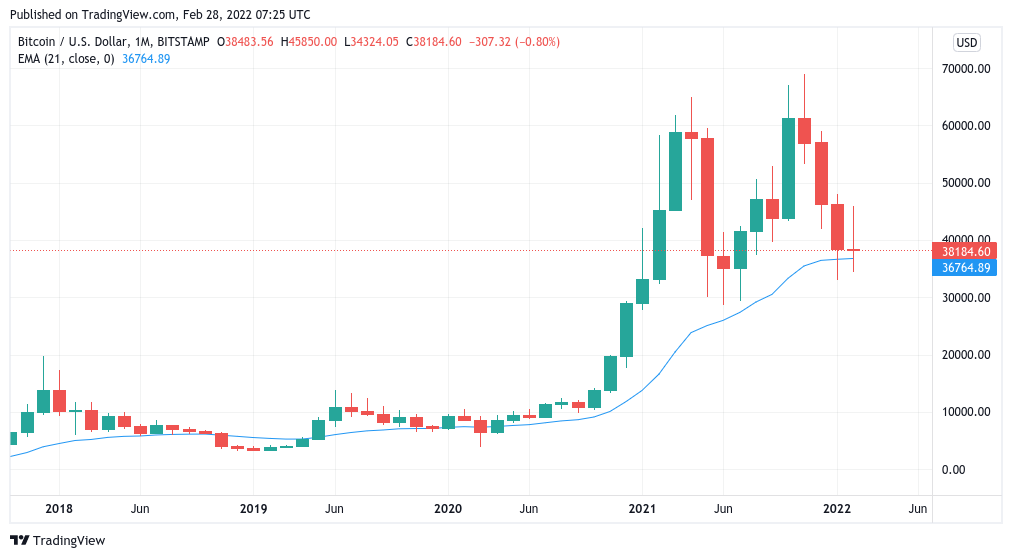

Relationships aside, Bitcoin has actually so far managed to remain in a fairly limited array, and also $40,000 is a clear resistance area for bulls to defeat.

The issue, nevertheless, is that any more dramatic actions might ultimately come as a result of significant macro modifications as well as therefore be an unreliable longer-term signal.

” Down regarding 4% on Sunday am 5:00 EST (Feb. 27) from Friday, Bitcoin is showing a harsh week for danger assets,” Mike McGlone, primary product strategist at Bloomberg Knowledge, warned.

Popular Twitter account Decodejar, on the other hand, keeps in mind that present degrees represent the supposed point of control for the past 15 months, with $38,000 seeing big volumes about other rate factors in the present range.

” When it comes to Bitcoin, the playing field appears rather easy,” a much more confident Michaël van de Poppe argued.

” Loan consolidation occurring after a favorable action throughout the past week. If you absolutely intend to see more momentum, then the modifications should not be that deep so $38.1-38.2 K must hold. After that, we could be going to $44K.”

With United States markets still to open at the time of composing, the picture might well change entirely before Monday is out.

A contrast to March 2020 might work– back then, Bitcoin first fell in line with global markets, just to rebound as a crooked wager that took hodlers on a bull run never ever seen prior to for the next 9 months.

https://twitter.com/TuurDemeester/status/1498059012327280649?s=20&t=ZLJ1uf-0nSjZJqlqwtJIxQ

An additional month, one more red candle.

Sunday’s close did not truly go according to plan for Bitcoin market onlookers.

A last-minute dive removed the chances of shutting the week as well as the month above $38,500, and therefore gave the background publications their first 4 straight month-to-month red candle lights because of the 2018 bearish market.

Currently, an unanticipated comedown recently’s events show up until now to just be making points even worse for Bitcoiners, who have yet to see the cryptocurrency branch off by itself, far from traditional possessions.

Likewise causing a migraine for analysts is the regular monthly graph about its 21-month exponential relocating average (EMA), which could be proper to go away as assistance must losses continue.

The 21 EMA being broken has actually been a typical function of macro bear trends for Bitcoin, with February mercifully staying clear of a repeat performance.

” Tomorrow’s Monthly Close is important. If we close listed below $37,000 (purple 21m/EMA) that provides us the exact same bearish signal as all other previous Macro Downtrends,” expert Kevin Svenson advised versus a chart revealing the degree.

Bitcoin previously failed to redeem two crucial moving standards as a pretext for retaking higher resistance degrees nearer all-time highs from November. The outcome, analyst Rekt Funding cautioned at the time, could be a prospective taking another look at the array reduced at $28,000.

On the bonus side, Bitcoin’s 200-week relocating average, criteria that a couple of belief will certainly be challenged as assistance, crossed $20,000 for the first time this weekend break.

Difficulty steadies the ship.

Averting from geopolitics, capitalists have every reason to maintain faith in the toughness of the Bitcoin network.

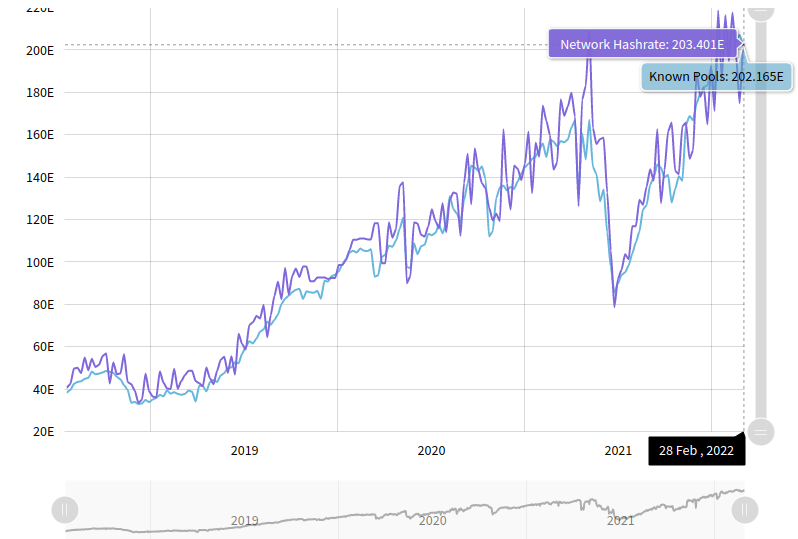

Regardless of price stress and also uncertainty on practically every duration, miners maintain mining, and the hash price and difficulty have actually maintained climbing.

Today might see an obstacle to the status quo– the hash rate is constant, however trouble results from reducing for the first time in 12 weeks to take the most recent become account.

This is nothing “bad” as a sensation– the 1.25% reduction is moderate by Bitcoin’s requirements and also most likely reflects circumstantial changes in miner engagement, as opposed to the start of a new pattern.

According to monitoring resource MiningPoolStats, hash price, for its part, remains above 200 exahashes per 2nd, a quantum leap from also an issue of months back when Bitcoin struck its all-time highs.

The aberration of fundamentals from rate has actually been extensively covered over the past year.

The concern now is whether the price will follow the hash rate as in years gone by.

Sentiment forecasts are the most awful.

Bitcoin, real to its concept, does not seem to have actually “liked” the introduction of a new armed problem in Europe.

Its possible duties apart, the largest cryptocurrency is not enjoying a belief boost as a result of recent occasions.

According to the Crypto Concern & Greed Index, a belief sign that has seen enhancing attention in 2022, the marketplace is obtaining quickly a lot more worried.

BTC/USD saw a fairly tiny dip overnight into Monday, however, that was still sufficient to drag the Index back into its “severe worry” region– from 26/100 on Sunday to 20/100, it’s the least expensive because Feb. 22.

For context, January’s neighborhood lows of $32,800 created a reading of 11/100 for Worry & Greed, this level often comprising macro lows in recent times.

Reacting, analysts nevertheless suggested that the rate decrease into Monday could be a forewarning by the free enterprise that doom, as well as gloom, will certainly reign supreme come to the beginning of TradFi market trading.

https://twitter.com/jsblokland/status/1498034407587856388?s=20&t=-ZrLOnN0qmfVhXFV5nkNAw

Meanwhile, crypto’s traditional equivalent, the Fear & Greed Index, was also in a “severe worry” setting recently prior to healing.